Earn More. Impact More.

Charitable Gift Annuity Rates Increasing in 2024

With the turn of a new year, there's more reason than ever to build your legacy with a charitable gift annuity (CGA).

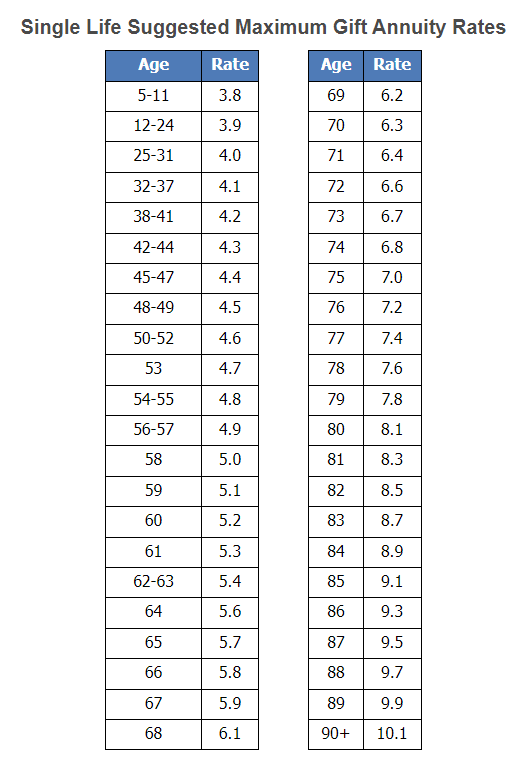

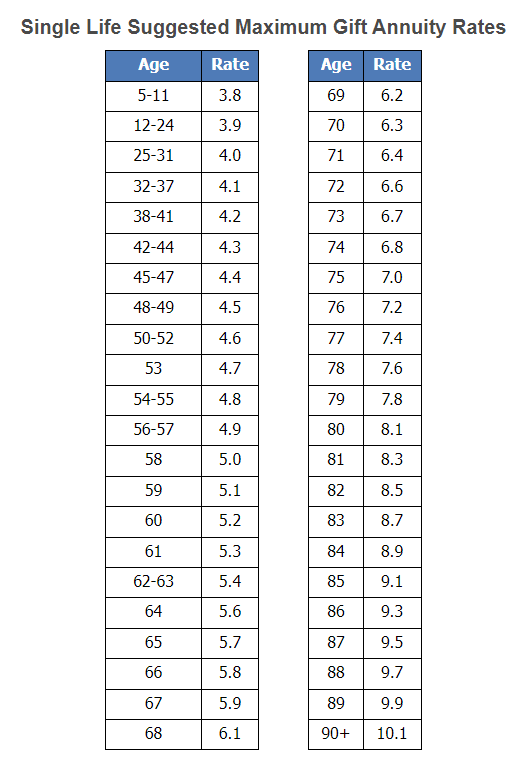

CGA rates increased on January 1, 2024.

For "Two Lives - Joint and Survivor" suggested maximum gift annuity rates and additional information, click here.

A charitable gift annuity is a way you can make a gift to your favorite charity and receive fixed payments for life in return. The payments can begin immediately or be deferred to a future date. - American Council on Gift Annuities

Benefits of a Charitable Gift Annuity

- Based on life expectancy, older annuitants (the person or people receiving the CGA payments) have higher payment rates.

- You have the potential to increase disposable cash flow.

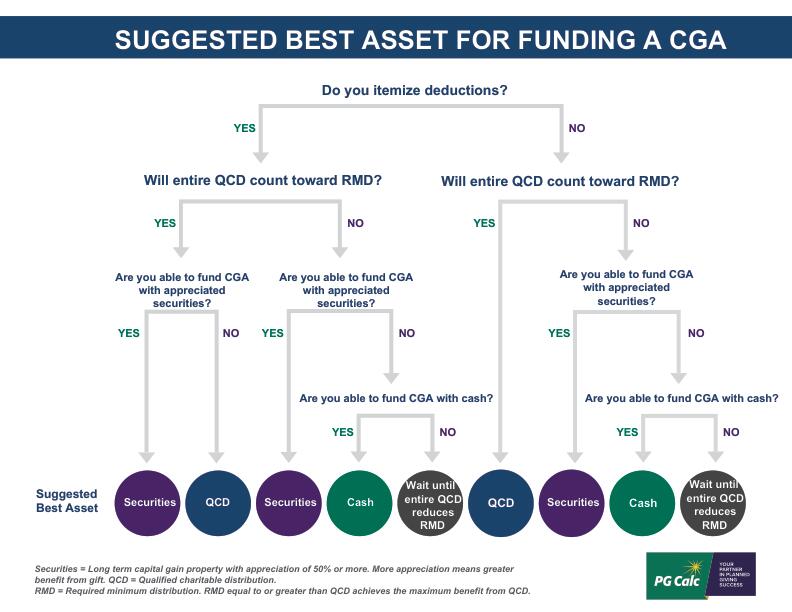

- If you itemize, you may receive a charitable income tax deduction in the year you set up the gift annuity.

- Each year a portion of your payment is income tax-free until you reach your anticipated life expectancy.

- If you fund your gift annuity with appreciated property, rather than cash, you could benefit even more with favorable capital gains tax treatment at the time of your gift.

- After your lifetime, the remaining portion of your gift will support our Methodist Hospital Foundation mission, helping to fulfill your philanthropic goals.

Want to talk with us about establishing a CGA?

Our planned giving team would be happy to speak with you in confidence, with no obligation.

Dana Ryan

Philanthropy Officer

Phone: (402) 354-4825

Email: Foundation@nmhs.org

8701 W. Dodge Road, Suite 450

Omaha, NE 68114